tracks are running all across the us on sunday april 16 that bettors want to bet at nassau otb?

Kevin mccaffrey says put it on the f list

nassau county can steal but not rob

call your local snd state legislator to open nasssau otb on sunday apri 26 so money can be made

put kevin mccafffrey on the f list

he can pray ehile we bet

Nassau lawmakers move to reinstate senior tax abatement

ys but not the holidays of Greeks.

I-

Thanks for the help. The item’s below. I’d be happy to mail you a copy, if you give me a mailing address.

Claude Solnik

Long Island Business News

2150 Smithtown Ave.

Ronkonkoma, NY 11779-7348

Home > LI Confidential > Stop scratching on holidays

Stop scratching on holidays

Published: June 1, 2012

Off Track Betting in New York State has been racing into a crisis called shrinking revenue. Some people have spitballed a solution: Don’t close on holidays.

New York State Racing Law bars racing on Christmas, Easter and Palm Sunday, and the state has ruled OTBs can’t handle action on those days, even though they could easily broadcast races from out of state.

“You should be able to bet whenever you want,” said Jackson Leeds, a Nassau OTB employee who makes an occasional bet. He added some irrefutable logic: “How is the business going to make money if you’re not open to take people’s bets?”

Elias Tsekerides, president of the Federation of Hellenic Societies of Greater New York, said OTB is open on Greek Orthodox Easter and Palm Sunday.

“I don’t want discrimination,” Tsekerides said. “They close for the Catholics, but open for the Greek Orthodox? It’s either open for all or not open.”

OTB officials have said they lose millions by closing on Palm Sunday alone, with tracks such as Gulfstream, Santa Anita, Turf Paradise and Hawthorne running.

One option: OTBs could just stay open and face the consequences. New York City OTB did just that back in 2003. The handle was about $1.5 million – and OTB was fined $5,000.

Easy money.

Live Racing Search Results

| Sunday, April 16, 2017 |

| Track Code | Track Name | Entry | Scratch | 1st Post ET | 1st Post Local | Time Zone | Stakes Race(s) | Stakes Grade | T.V. Indicator |

|---|---|---|---|---|---|---|---|---|---|

| EMD | EMERALD DOWNS | 72 | 24 | 5:00 PM | 2:00 PM | PDT | |||

| GG | GOLDEN GATE FIELDS | 48 | 24 | 3:45 PM | 12:45 PM | PDT | |||

| GP | GULFSTREAM PARK | 72 | 0 | 1:15 PM | 1:15 PM | EDT | |||

| HST | HASTINGS RACECOURSE | 96 | 0 | 4:50 PM | 1:50 PM | PDT | |||

| LA | LOS ALAMITOS (MX) | 72 | 48 | 8:00 PM | 5:00 PM | PDT | |||

| LRL | LAUREL PARK | 72 | 0 | 1:10 PM | 1:10 PM | EDT | |||

| SA | SANTA ANITA PARK | 72 | 24 | 3:30 PM | 12:30 PM | PDT | |||

| SUN | SUNLAND PARK | 120 | 24 | 2:30 PM | 12:30 PM | MDT | Sunland Park H. | ||

| Copper Top Futurity | |||||||||

| WO | WOODBINE | 72 | 48 | 1:00 PM | 1:00 PM | EDT |

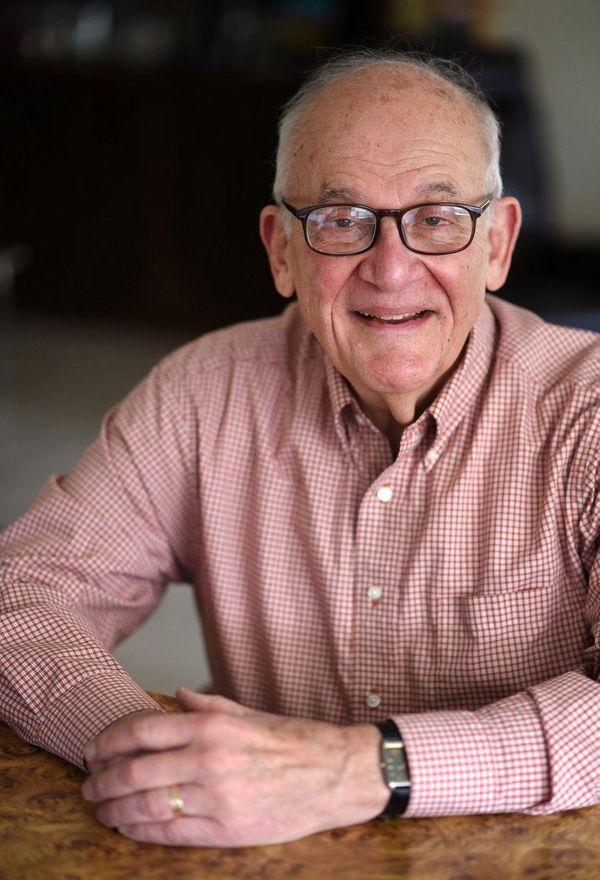

"This is going to affect a lot of people, and they never said anything," Irwin Scharf of Massapequa said about Nassau County's property tax abatement expiration, Friday, Jan. 13, 2017. Photo Credit: Danielle Finkelstein

State and local lawmakers from Nassau County are moving to bring back a popular property tax abatement for seniors that had expired without any notice to its tens of thousands of recipients.

The county legislature’s Republican majority on Tuesday introduced a bill formally requesting that the State Legislature — which must authorize all local tax abatements — extend the benefit. The resolution, known as a “home rule message,” came as both the State Senate and Assembly were drafting the necessary legislation on their end.

The flurry of bills came after Newsday this week detailed that many seniors were surprised to see their most-recent tax bills missing the popular abatement, which was established in 2002 to offset a 19.3 percent county property tax hike passed that year.

The original state and county legislation creating the senior abatement always called for its expiration last year, but county officials provided no advance notice, leaving many seniors to call their local and state representatives for an explanation after seeing their tax bills increase by roughly $200.

“The really amazing thing is that it actually resulted in something,” said Irwin Scharf, 81, of Massapequa, who was one of the residents who complained to his local representatives when he noticed the abatement missing from his newest tax bill.

County officials estimated that the abatement saved eligible seniors (those older than 65 and earning less than $86,000 a year) 5.5 percent on their annual general property tax bill — a portion of their overall bill.

ADVERTISEMENT | ADVERTISE ON NEWSDAY

A Newsday review shows that 43,861 properties had the abatement in 2015-16, and that the average abatement was $166 over the last five tax years, removing between $6.8 million and $7.7 million annually from the tax rolls.

When first contacted about the expired abatement, County Executive Edward Mangano and GOP county legislators asserted that it was no longer needed, since they had largely frozen property taxes since taking control of government in 2010. They also sparred with Democratic state lawmakers over who was to blame over the abatement’s lapse.

After the public outcry, however, all sides sought to act quickly for a restoration. County Legislature Presiding Officer Norma Gonsalves (R-East Meadow) said Tuesday: “We hope that our state legislators accept our home rule message and submit the appropriate extension legislation at the state level immediately.”

She said legislators want the abatement to retroactively cover this tax year, allowing affected residents to get a refund for any increases. Mangano, a Republican, said he supported the legislature’s effort.

State lawmakers, meanwhile, said they believe the abatement extension will pass in Albany.

“There does not appear to be obstacles,” said State Sen. Kemp Hannon (R-Garden City), a sponsor of the Senate bill. “But the key word is ‘appear.’”

Assemb. Charles Lavine (D-Glen Gove), who is co-sponsoring the Assembly bill — and running for county executive, said: “It’s a shame that we had to get to this point, but nothing like a little crisis to provide an opportunity to set this right.”

No comments:

Post a Comment