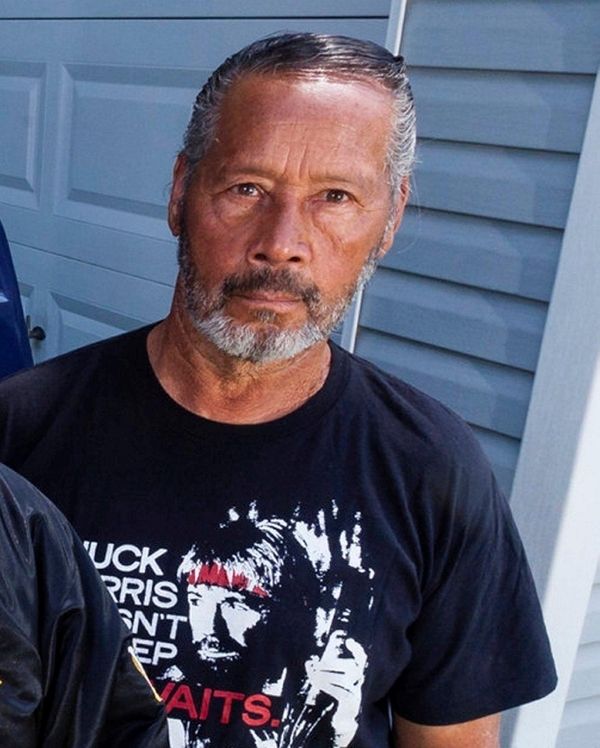

Milton Acosta, of West Babylon, worked for companies that paid into the Road Carriers Local 707 Welfare and Pension Funds, on May 20, 2016. Photo Credit: Heather Walsh

A federal agency has declared a Hempstead-based union pension fund insolvent, a move that has resulted in additional benefits cuts for the plan’s nearly 4,000 retirees.

The retirees receiving benefits from Road Carriers Local 707 Welfare and Pension Funds are getting less than half of what they were promised.

The Pension Benefit Guaranty Corp., an agency of the Labor Department that insures private-sector pensions, said Wednesday that it had started providing financial assistance to the pension fund, whose retirees worked for different employers in related industries like trucking and warehousing. Such plans are called multi-employer pension funds.

Similar plans nationwide, including two others on Long Island, have been hit hard because of the declining numbers of employers contributing to the funds, and investment losses incurred during the financial crisis in 2008 and 2009, the agency said.

So many trucking companies have failed or consolidated that at many pension funds retirees far outnumber workers. That decline has left the funds short of cash because companies pay into the pension funds based on the number of active workers. For Local 707’s pension fund, the ratio is about five retirees for every worker.

The PBGC said the Local 707 retirees’ benefits were cut on Feb. 1 to bring them in line with the maximum payout allowed at funds the agency assists. That reduction followed a 40 percent cut the plan made last year as the fund struggled to pay retirees.

ADVERTISEMENT | ADVERTISE ON NEWSDAY

After the first cut, the pension plan’s trustees sought permission for another cut to keep the fund from going broke. But the PBGC rejected that bid because it concluded that the move would not restore the plan to solvency.

Unlike with single-employer pension plans, the PBGC doesn’t take over the multi-employer pension funds. Instead it provides financial assistance while the funds’ trustees continue to administer it. Local 707’s fund is administered by four trustees, including fund administrator Kevin McCaffrey, who is also a Suffolk County legislator.

Milton Acosta, a 74-year-old retired forklift driver in West Babylon, has seen his monthly pension decline from $2,223 a month to $831, after the two cuts.

“I had to declare bankruptcy last year after the first cut,” he said yesterday. “I don’t know what I am going to do now.”

Neil DeStefano, a 73-year-old retired warehouse worker from Franklin Square, said his pension has dropped from $2,200 to about $850.

“It’s been a lot of pressure on me,” said DeStefano. “I am afraid that I am going to lose my house.”

McCaffrey blames the pension’s woes on government rules that don’t allow the multi-employer funds to adjust benefits before they run out of money.

“It is a broken pension system that needs to be fixed,” he said.

Some of the retirees also blamed the federal government for not taking a more active role.

“The government has bailed out all these banks, and they aren’t doing anything for us,” DeStefano said.

No comments:

Post a Comment