fund ....

PBGC Provides Financial Assistance to Road Carriers Local 707 Pension Fund - Participants’ Benefits Payments Cut to PBGC Guaranteed Levels

FOR IMMEDIATE RELEASE

March 01, 2017

March 01, 2017

WASHINGTON, D.C. - The Pension Benefit Guaranty Corporation has started providing financial assistance to the Road Carriers Local 707 Pension Fund, a newly insolvent multiemployer pension plan based in Hempstead, New York. The financial assistance will help pay the guaranteed portion of pension benefits earned by nearly 4,000 participants.

For the past year, the 707 Fund has been unable to pay full benefits at the levels promised under the plan, and reduced retirees' benefits to levels that were supportable by available plan assets. However, starting February 1, 2017, benefits to retirees were cut back further to the PBGC guarantee limits set in law for insolvent multiemployer plans.

The full benefit promised to current retirees and beneficiaries in the 707 Fund averages $1,313 per month, but the average guaranteed benefit is $570. Forty-two percent of the 707 Fund retirees and beneficiaries have benefit reductions of more than half, compared to the amount of their promised benefits. Only 7 percent of current retirees and beneficiaries will receive their full plan-promised benefit amount.

The 707 Fund is among a number of troubled multiemployer plans that have projected they will run out of money during the next 20 years and will likely call on PBGC for financial assistance. Guaranteed benefits for the 707 Fund retirees, and participants in other insolvent multiemployer plans, will be reduced even further if steps are not taken to address the deteriorating financial condition of PBGC's multiemployer insurance program. The PBGC program is likely to run out of money by 2025. If this happens, PBGC's premium income will only provide retirees with a small fraction of their benefit.

"Over a million people participate in multiemployer pension plans that are expected to run out of money over the next 20 years," said PBGC Director Tom Reeder. "The insurance program for insolvent multiemployer plans is in dire financial condition and, absent reform, is likely to run out of money by 2025. I am committed to working with the Administration, Congress and other stakeholders to find solutions that stabilize multiemployer pension plans and make the pension insurance program one that people can rely on well into the future."

PBGC will initially provide assistance of $1.7 million per month to the 707 Fund. That amount, together with employer contributions and other income, will allow the pension fund to pay retirees' benefits at the level guaranteed under federal pension law. The amount of PBGC's future financial assistance will vary based on changes in the plan's income and cash needs for guaranteed benefit payments and administrative costs.

Unlike PBGC's program for terminated single-employer pensions, PBGC doesn't take over administration of insolvent multiemployer plans. The 707 Fund will continue to administer the plan. Participants with questions about their benefits should contact the Fund Administrator.

Like other financially troubled multiemployer plans, the poor financial condition of the 707 Fund is the result of several trends. They include a steady decline in the number of participating employers and aggregate employer contributions, increases in plan benefit levels that were not adequately funded, and investment losses suffered in the 2008-2009 financial crisis. The 707 Fund covers retired and current truck drivers represented by the Teamsters Local Union 707.

PBGC's Multiemployer Program PBGC runs two separate pension insurance programs: single-employer and multiemployer. The programs differ significantly in the level of benefits guaranteed, the insurable event that

triggers the guarantee, and premiums paid by insured plans. The two programs are financially separate.

triggers the guarantee, and premiums paid by insured plans. The two programs are financially separate.

Unlike the agency's program for single-employer pensions, PBGC doesn't take on the administration of insolvent multiemployer plans. Instead, the agency provides financial assistance so the plans can pay benefits at no more than the PBGC guarantee level. The guarantee limits for failed multiemployer plans are significantly lower than for terminated single-employer plans. The PBGC guarantee limits for people in multiemployer plans are based on years of service and the rate that benefits are earned under the plan.

The insolvency of the 707 Fund is the first among a number of larger financially troubled multiemployer plans with benefit levels that significantly exceed the PBGC guarantee limit. In the past, failed multiemployer plans tended to be small plans or promised relatively modest benefits. A 2015 PBGC study found that twenty-one percent of participants in already insolvent multiemployer plans experienced a reduction in benefits when the guarantee limits were applied. However, the risk and magnitude of participants' benefit losses increases dramatically in the future when larger plans with higher benefits become insolvent and apply the guarantee limit.

In FY 2016, PBGC paid $113 million in financial assistance to 65 multiemployer plans that cover the benefits of over 86,000 participants.

About PBGC

PBGC protects the pension benefits of nearly 40 million Americans in private-sector pension plans. The agency is currently responsible for the benefits of about 1.5 million people in failed pension plans. PBGC receives no taxpayer dollars. Its operations are financed by insurance premiums, investment income, and with assets and recoveries from failed single-employer plans. For more information, visit PBGC.gov.

— ### —

PBGC No. 17-02

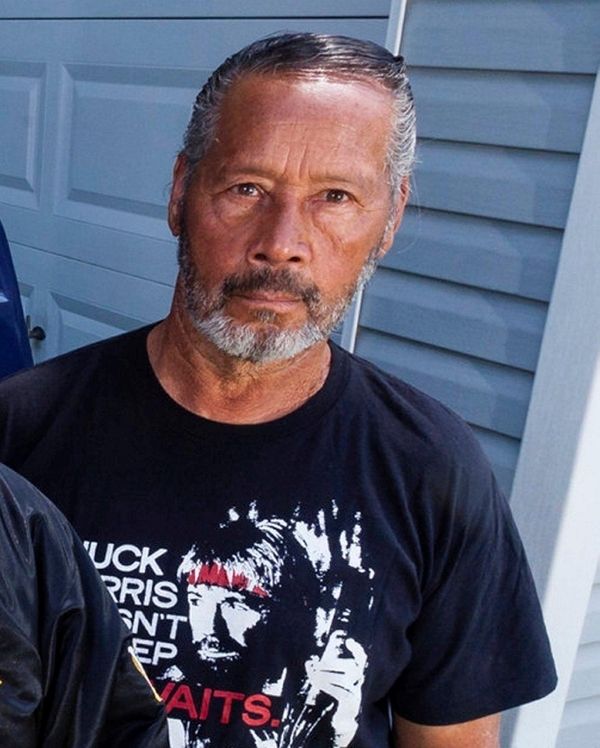

Milton Acosta, of West Babylon, worked for companies that paid into the Road Carriers Local 707 Welfare and Pension Funds, on May 20, 2016. Photo Credit: Heather Walsh

A federal agency has declared a Hempstead-based union pension fund insolvent, a move that has resulted in additional benefits cuts for the plan’s nearly 4,000 retirees.

The retirees receiving benefits from Road Carriers Local 707 Welfare and Pension Funds are getting less than half of what they were promised.

The Pension Benefit Guaranty Corp., an agency of the Labor Department that insures private-sector pensions, said Wednesday that it had started providing financial assistance to the pension fund, whose retirees worked for different employers in related industries like trucking and warehousing. Such plans are called multi-employer pension funds.

Similar plans nationwide, including two others on Long Island, have been hit hard because of the declining numbers of employers contributing to the funds, and investment losses incurred during the financial crisis in 2008 and 2009, the agency said.

So many trucking companies have failed or consolidated that at many pension funds retirees far outnumber workers. That decline has left the funds short of cash because companies pay into the pension funds based on the number of active workers. For Local 707’s pension fund, the ratio is about five retirees for every worker.

The PBGC said the Local 707 retirees’ benefits were cut on Feb. 1 to bring them in line with the maximum payout allowed at funds the agency assists. That reduction followed a 40 percent cut the plan made last year as the fund struggled to pay retirees.

ADVERTISEMENT | ADVERTISE ON NEWSDAY

After the first cut, the pension plan’s trustees sought permission for another cut to keep the fund from going broke. But the PBGC rejected that bid because it concluded that the move would not restore the plan to solvency.

Unlike with single-employer pension plans, the PBGC doesn’t take over the multi-employer pension funds. Instead it provides financial assistance while the funds’ trustees continue to administer it. Local 707’s fund is administered by four trustees, including fund administrator Kevin McCaffrey, who is also a Suffolk County legislator.

Milton Acosta, a 74-year-old retired forklift driver in West Babylon, has seen his monthly pension decline from $2,223 a month to $831, after the two cuts.

“I had to declare bankruptcy last year after the first cut,” he said yesterday. “I don’t know what I am going to do now.”

Neil DeStefano, a 73-year-old retired warehouse worker from Franklin Square, said his pension has dropped from $2,200 to about $850.

“It’s been a lot of pressure on me,” said DeStefano. “I am afraid that I am going to lose my house.”

McCaffrey blames the pension’s woes on government rules that don’t allow the multi-employer funds to adjust benefits before they run out of money.

“It is a broken pension system that needs to be fixed,” he said.

Some of the retirees also blamed the federal government for not taking a more active role.

“The government has bailed out all these banks, and they aren’t doing anything for us,” DeStefano said.

| |

Road Carriers Local 707 Fund Office

14 Front Street, Suite 301

Hempstead, NY 11550-3602 Phone 516-560-8500 or 1-800-366-3707 Fax 516-486-7375

Interim Fund Manager

Kevin McCaffrey, CEBS Board of Trustees

Appointed by Union

Kevin McCaffrey, CEBS Vincent Cangelosi

Appointed by Employers

Tom J. Ventura Lamar Beinhower  Road Carriers Local 707 Welfare and Pension Funds

Road Carriers Local 707 continues to bring you the quality of service that you expect as a Local 707 member.

We now have our Health and Welfare Fund Summary Plan Documents online in PDF format.You must have Adobe Acrobat Reader installed on your computer before you are able to view any of our documents in PDF format.

You will need Adobe Acrobat to view these files. Download Acrobat at Adobe's Website. You will need Adobe Acrobat to view these files. Download Acrobat at Adobe's Website. | |

No comments:

Post a Comment